“All Change Please. This train terminates here. There is a replacement bus service in operation that will take you to your onward destinations.”

That’s what you, in effect, may as well be saying to your clients and distributors when it comes to your investor communications. Regulation and ESG Performance Reporting are now seriously challenging Client Service and Marketing teams to rethink their reporting processes. Why? Because operating a replacement bus service is simply not good enough. And that is what many asset managers are doing when it comes to client reporting.

It is not new conversation to suggest that regulatory and governing body rules have significant bearing on client reporting and fund marketing. The need to review disclosures, footnotes, and associated declarations are part and parcel of the continuous review of reporting processes. That said, there is now also something else afoot that is forcing asset managers to rethink their overall reporting business processes and the technology they use to support these processes.

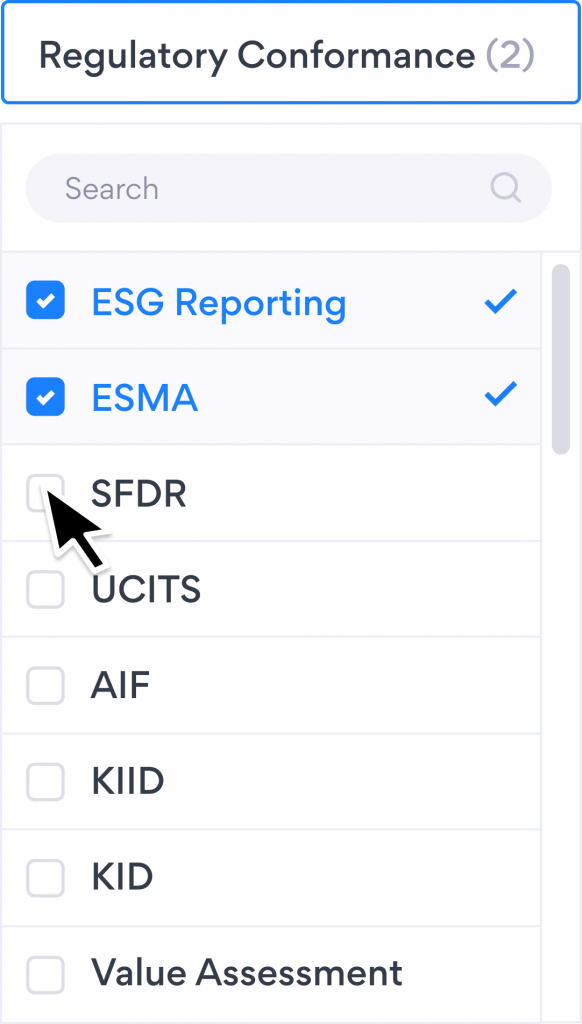

For our customers, the reason is simple. They are experiencing multiple collisions all at the same time. Reporting not only needs to capture the necessary changes to fulfil regulatory conformance to rules associated with mandatory regulations such as Sustainable Financial Disclosure Regulation (SFDR), but they also need to capture investor demand to have deeper portfolio introspection including issuer level reporting around ESG. ESG Performance Reporting is a real client reporting “thing” now. Couple this, with additional forthcoming regulations (see ESMA changes below) and industry initiatives (e.g. Assessment of Value) and it does not take too much thinking to conclude that existing siloed technology and associated business processes will not cope.

The reason for this is equally as simple. Many incumbent reporting systems do not offer the template and component flexibility to meet the agile needs that reporting teams now require. Furthermore, these legacy systems don’t facilitate a necessary parallel world of online reporting alongside conventional periodic report production. Both channels need to co-exist alongside each other and be served using the same data and associated content. And the content is complex. Is not just disclosures and risk statements, it’s the prose, diagrams, and visualizations that support ESG Performance reporting.

With all this said, it’s the ever-evolving permanence of regulatory requirements that remind us that your investor communication strategy needs to be supported by agile technology. These regulatory changes are a constant. Take the changes being introduced under the forthcoming ESMA (European Securities and Markets Authority) rules. They have published formal guidelines directly relating to marketing communications and associated materials under the regulations for cross-border distribution.

Whilst the interpretation of this set of guidelines, and its applicability to your cross-border promotional strategies remains subjective, there are material changes that you may need to apply. For example:

- The guidelines are aimed at all types of promotional materials associated with funds falling under the UCITS and AIF regulations.

- It is generally regarded that all forms of media fall within this scope including client reports, website fund centers, product pages, featured fund pages as well as traditional marketing materials such as fact sheets and fund reports.

- Any inclusion of fund information in client reporting will need to observe these changes.

- As a specific example, the guidelines suggest the insertion of the following statement, including display issues such as prominence and font size, on all promotional materials (including digital):

“This is a marketing communication. Please refer to the [prospectus of the [UCITS / AIF / EuSEF / EuVECA] / Information document of the [AIF / EuSEF / EuVECA] and to the [KIID / KID] (delete as applicable)] before making any final investment decisions.”

- Where there are sections on Risk & Rewards, there are now more specific guidelines on presentation.

- There is an expectation that marketing materials contain a more in-depth explanation of the costs associated with an investor buying, selling, or switching units in a fund.

- Performance reporting, as a minimum, needs to be in-line with that provided in the legal prospectus and KIID, including the inclusion of 10 Year Performance.

- Marketing materials need to contain links to important documents such as those relating to sustainability disclosures of the fund.

The changes will never cease. The solution lies with agile technology that supports omnichannel investor communications which manage publication-ready data and content consistently across your business. Internal, Client, and Regulatory Reporting need to be derived from the same venue.

The intersection of regulation and ESG Performance reporting provides you with a unique opportunity to rethink your vision for investor communications and begin to see how modern, technology-driven solutions can power that vision.

At Kurtosys, we are proud of our fast, scalable and easy to use technology. We love solving customer experience problems with smart applications of technology and creativity. Among our many solutions, we offer high performance client portals, fund centers, information for fund buyers, and full website solutions.

Get in touch today, we’d love to hear from you. Talk to our team and arrange a demonstration of how our solutions and our tools can add value to your customer experience.