In this series we are sharing some insights into the best practices around building and managing investment management sites.

It is almost a decade ago now, that we started noticing that managing large scale investment management sites was a persistent pain-point for our clients.

Typically investment managers would choose a vertical content management system (CMS) like Adobe or Drupal, write a lot of custom code and, two years later, launch their site with crossed fingers in the hope that the outcome was pleasing to users and still in line with latest UX trends. This approach then left little wriggle-room to make any changes or adaptations, even though the build was based off a plan hatched 24 months prior.

To begin with, we’ll unpack the factors to consider in choosing a solution and, in preemptive conclusion, we can confirm that they are as valid today as they were 7 years ago when we started designing and building an investment management industry-specific digital experience platform (DXP).

Data, data, data

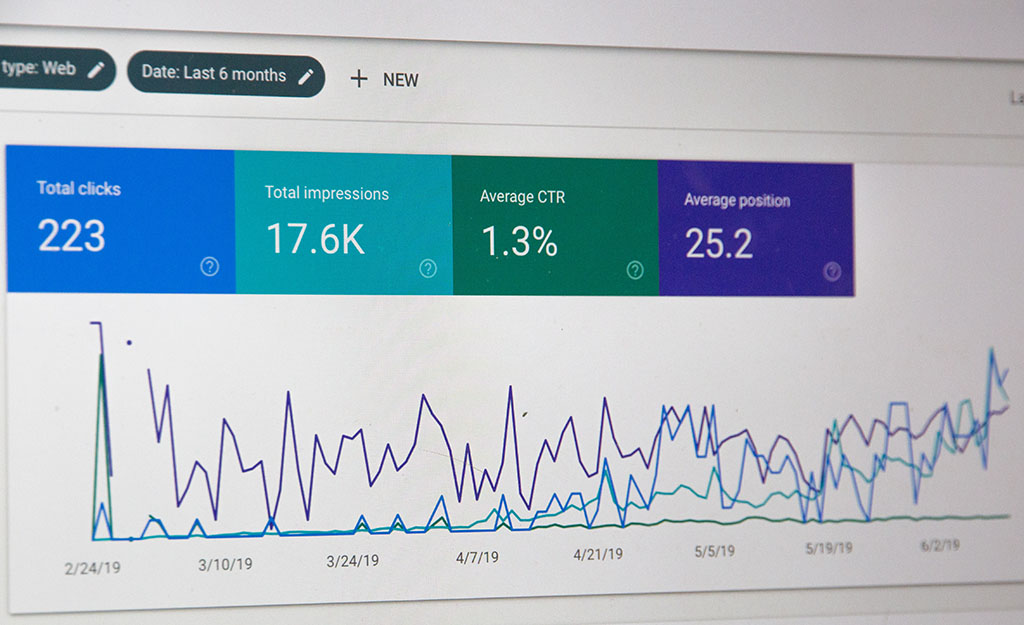

In our experience 80% of the effort expended in building an investment-focused site will be dedicated to building fund pages and other content with data at its core. The primary challenge is reliably weaving accurate data into the pages in an engaging, useful and relevant way. This data is usually presented as charts and interactive components, all requiring custom development. In addition, page lifecycles must be managed, a risky and time-consuming task in many instances, especially for UCITS products and their expansive range of share classes. Finally, since these pages attract the most valuable traffic to your site, they need to be easily discoverable by search engines. Automating the tagging of these pages, optimizing URLs, and ensuring all SEO is applied correctly gives any investment management site a real advantage over competitors. Yet none of these critical items are delivered out of the box by horizontal solutions.

Coping with the strict watch of Compliance

Investment sites are subject to incredibly stringent regulations, and need to withstand the strict watch of compliance. Record retention of marketing materials is a good example of one of the common requirements. While it is easy to print your factsheets once a month when you issue new versions, keeping a daily snapshot of your product pages every time the daily NAV changes, is much more challenging. Yet the risk to be mitigated by both actions is the same.

Another example is the risk created by time-sensitive claims in insights shared publicly that are still accessible at a later period in time. For example, an investor could make an allocation to one of your funds based on market views you shared three years ago, which are no longer helpful or accurate. While we found that there are tools that already exist to address these challenges, none are weaved together in a way where they work simply and easily.

Marketing globally, accurately and at scale

Selling into multiple markets has some common themes across industries. Most global players need to consider cultural nuances, language barriers, and of course local market accessibility regulations.

However, the intersection of complex product marketing, compliance, data, and the translation of investment concepts for local markets makes global marketing efforts for investment managers truly challenging.

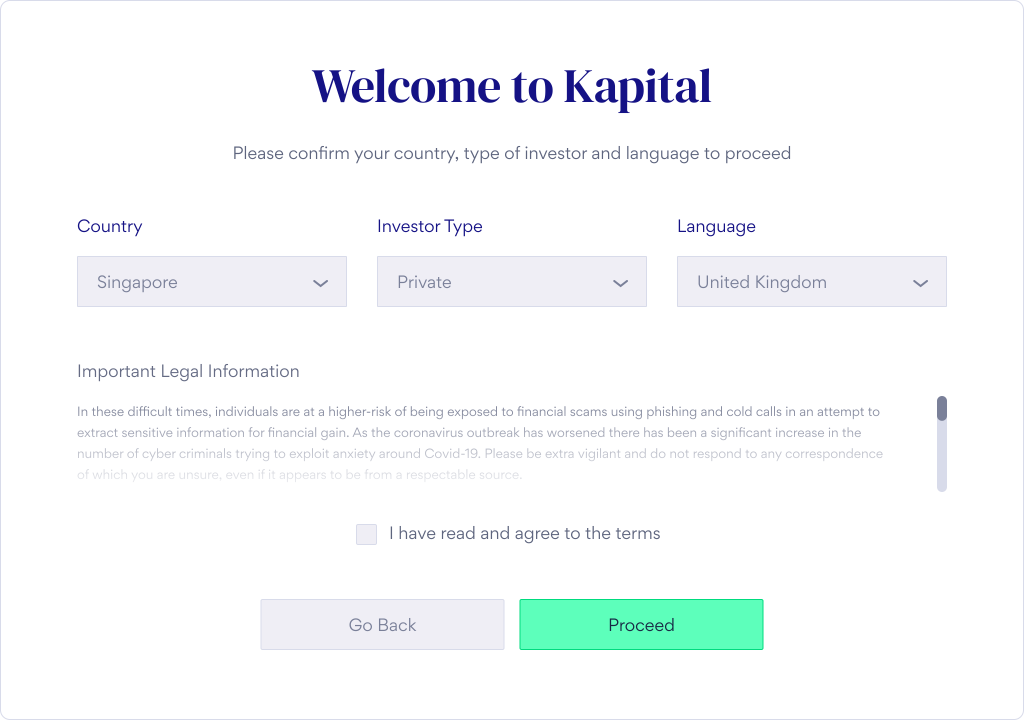

The challenge for marketeers begins at the regulatory attestation*, intended to make it simple for local language speakers to navigate to their country site in a compliant way. Beyond that, available products must be filtered automatically for the audience. All content must be translated, and key facts and claims about the firm must be represented consistently regardless of the language they are in. Insights published on your English blog must be localized for each market, but might need tailoring. As before, you can usually rig solutions to these problems, but they create friction for the marketing team and lower the velocity of distribution.

*Attestations are a requirement for many investment management sites to help serve their users relevant content, depending on their region and investor type. A user will therefore select or “attest” to their profile, for example, an intermediary investor from the UK.

Looking Forward

Your public site is one of the most important brand surfaces that investors and partners interact with. Developing a great corporate identity and design is where all investment management sites begin, but the journey to bring the vision to life can be long and hard. Understanding the pitfalls, the true cost of ownership, and how operating models can be changed with the right technology can make the journey much quicker and easier.

Seven years ago, we took the first step towards building a digital experience platform (DXP) specifically designed around the needs of investment managers. Today our DXP solution is used by some of the world’s leading investment brands and we are continuously refining and expanding our offering in close consultation with our clients.

If you are considering a web refresh or refinement, feel free to reach out for a conversation.

If you are interested in receiving further information on this and other topics on a regular basis, please sign up to our newsletter at the bottom of the page.

You can also request a demonstration of how our tools and services can add value to your digital transformation.