What has the collapse of SVB, First Republic and Signature Bank – and some heightened concerns about what others may follow – got to do with investment management, not to mention the niche regulations around Consumer Duty? It could be argued that there is absolutely nothing relating these two corners of the financial news space. In fact, consumer duty is not something that grabs home pages of any of the major financial news sites. Your author can’t find much at all about Consumer Duty in any of the mainstream financial press whereas when it comes to bank collapses, the headlines are large and the scriptwriters for the movies are scribbling away as we speak. Bank collapses linked to Consumer Duty. Mmmm, I don’t think so. But hold on…

Image: Investopedia.com

The influence of bank collapses

The recent bank collapses have raised fundamental questions about how banks manage themselves and juggle their balance sheets to make money by managing short term deposits (your money) and the longer-term assets they invest your money into. This “duration” imbalance brought these banks down when depositors started taking their money out. Matt Levine, a journalist at Bloomberg, explains this in elegant and easy-to-understand detail for those of you interested.

Disclosure: I have never met Matt Levine, but his lay-person style reporting is truly refreshing and gives us some lessons on how demystifying financial services is something we should all be promoting.

One debate that Matt Levine and many others are raising is concerns over the “insurance” levels depositors get when banks collapse and equally importantly, has shined a light on the meagre interest rates we (you and I) get on our bank account deposits. You won’t be surprised that you get something close to zero even though central banks rates in the UK (UCITs KIIDs), Europe and the US are approaching 5%.

The rise of retail investment management

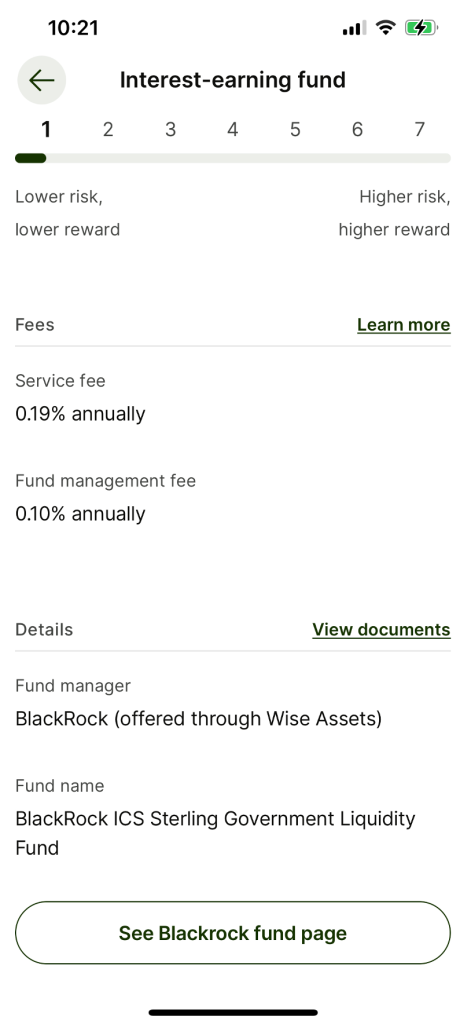

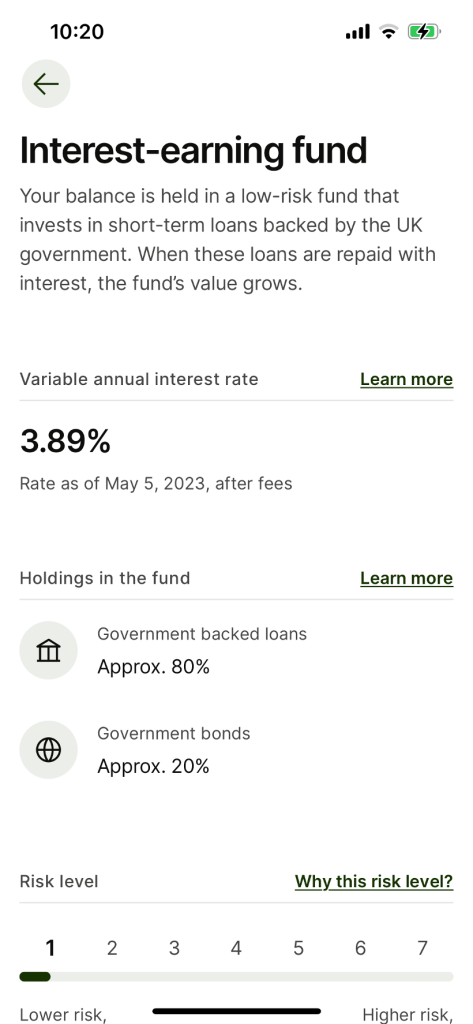

Enter a new wave of how our traditional notion of banking is increasingly intersecting with retail investment management. I recently opened the Wise App which I have an account with. Wise is NOT a Bank. It is a so-called Money Services provider with roots in letting you convert currencies of any denomination into pretty much anything else. The interesting thing is that Wise popped up with a really timely proposition for me: Hey, deposit your money with instant liquidity, no deposit insurance limit and get 3.89% on it. So, with limited hesitation, I did it. A few clicks and I was done and accruing interest on some savings that I was previously getting nearly nothing back in interest.

Here is the intersection with investment management and why so called “narrow banking” has arrived. I have used a non-bank to give what is, for all intents and purposes, a current account for me. Not only that but my money is in the safe hands of BlackRock via one of their low-risk cash mutual funds (the fund has some minor idiosyncrasies such as being “constant NAV (Net Asset Valuation)”, but this is technical). There is some beauty in this. My money is with BlackRock, one of the most well-known investment managers in the world and is earning me interest that is more than I can get at my traditional bank. I don’t think there is a catch to this but please respond if I have missed something. Now comes the intersection with Consumer Duty. From my Wise App, I can link directly through to BlackRock’s fund page to learn a bit more about how my money is being managed.

And this is why Consumer Duty is so important for the investment industry

I can now use my preferred money transfer provider to manage my savings in a completely transparent way through an investment manager – and it all feels like a current account. Consumer Duty is a here and now thing because it really matters. The Blackrock fund page is information rich, well presented, and detailed. In fact, it might be too detailed. I have no doubt that Consumer Duty will lead BlackRock to apply improvements to their fund pages over time to make them more retail investor friendly. This will be through decluttering the user experience, simplifying language and de-surfacing details that may only matter for savers who have had more technical exposure to financial products. Also, we can see now why Consumer Duty intersects with in-flight directives such as Assessment of Value. These two pieces of our regulatory framework in the UK are closely aligned.

*Screenshots from the Wise App

Having attempted to link Consumer Duty to the more topical agenda of banks and their collapse, we can now also start to think about what that means in a wider, near-future context. Today Wise may point me towards a very safe, instant liquidity, current-account-like product. Tomorrow, they may point me towards a whole array of funds. Some may be pretty-cautious but in the future, I see no reason why I cannot have access to riskier proposition including direct investments in lending, private equity, and the like. It is then we will see that banking will have truly changed. I am certainly not saying this will happen, but we may all thank the regulator for Consumer Duty if it happens.