Most pitchbooks today are graveyards of slides, static, bloated, and out-of-date before they even reach the client. But distribution is not about slides. It is about stories. To win meetings and mandates, we need to move beyond dumping data and give clients narratives they can remember and act on.

Research shows why this works. Jennifer Aaker at Stanford found that stories are remembered up to 22 times more than facts alone. Pair the two and you reach both head and heart.

Data informs. Stories persuade.

Our industry produces data well but struggles to make it meaningful. Heads of distribution often juggle multiple audiences, reformat content into several versions, and still leave clients and prospects with more charts than clarity. Meanwhile, investors expect personalised, digital, and easy-to-understand communications, not pages of static data.

Stop presenting slides. Start telling stories.

Michelle Wright - Chief Product Officer, Kurtosys

The customisation imperative

The one-size-fits-all pitchbook is over. Different clients need different stories. Personalisation is no longer optional. It is essential for engagement and retention. In a recent study, 42% of institutional investors said they would divest based on poor reporting quality alone. Yet, only 8% of firms surveyed are able to provide full customisation to their clients. If the narrative does not match the audience, the deck becomes noise. Firms that can tailor emphasis, language, and evidence by persona without creating conflicting versions will win.

Technology as the story enabler

Distribution teams have long struggled with static pitchbooks. Quarter-end scrambles, endless reformatting, and the risk of sending inconsistent or out-of-date decks are common problems. It’s like showing up to a meeting with a printed encyclopaedia in the age of Google.

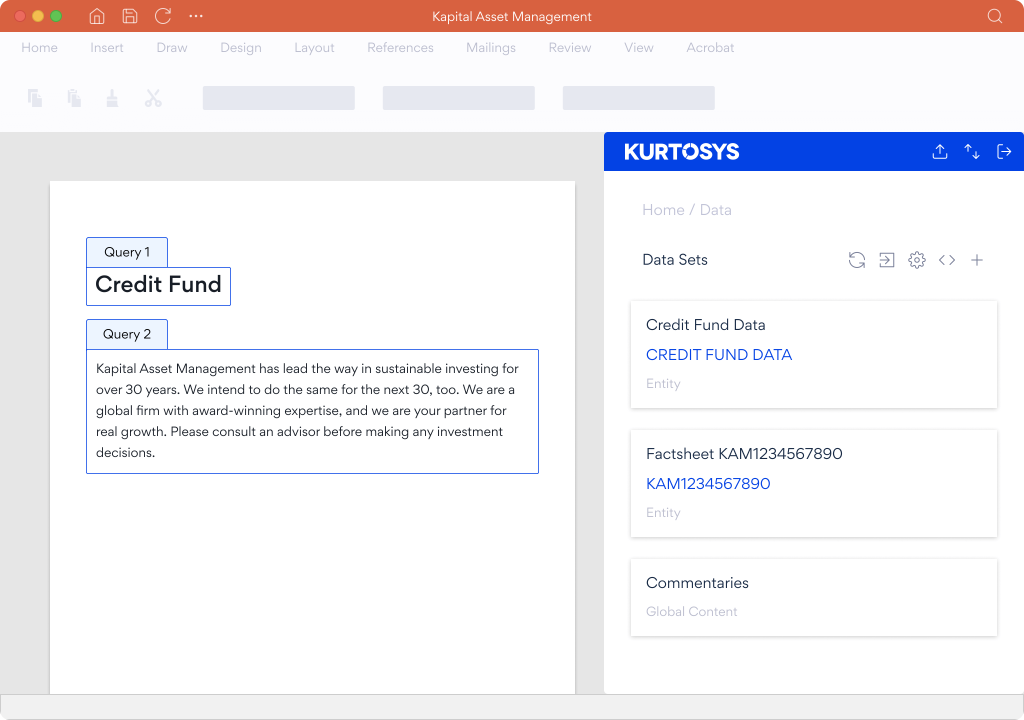

This is why we built the Kurtosys flexible reporting platform. It helps you tell the right story with less effort. It handles data, workflows, and compliance in the background, while your teams use the tools they prefer, be it Microsoft PowerPoint or Adobe InDesign. Both tried and tested, with new features being added all the time.

Now, distribution teams can:

- Dynamically generate pitchbooks that stay current with live data on performance, risk, holdings, and ESG metrics

- Use audience-aware templates to show the metrics that matter most for each client or meeting

- Deploy reusable story blocks alongside visuals to control the message while ensuring numbers are accurate

- Rely on compliance and brand guardrails to meet Consumer Duty, SEC or Accessibility requirements and keep communications clear and fair

- Design once and deploy anywhere, generating Microsoft PowerPoint decks, PDFs, and secure portal content from the same governed components

The market gap

When distribution teams look for solutions, they often find options that solve part of the problem. Each category is typically optimised for a different primary goal:

- Slide productivity tools (like UpSlide, Macabacus, Shufflrr, SlideHub) are effective at improving creation speed, though their core focus may not be investment-grade compliance or data-governed narratives.

- Data-vendor plug-ins (from Bloomberg or Factset) are excellent for live data updates but can be less flexible for crafting stories that integrate multiple data sources.

- Enterprise sales-enablement suites (like Seismic or Highspot) offer robust governance and analytics, often as part of a comprehensive, large-scale implementation.

- Legacy client-reporting suites remain dependable for periodic factsheets but are typically less agile for the dynamic, audience-specific needs of meeting-room storytelling.

A purpose-built platform for investment communications

Kurtosys was designed to fill this gap. As a platform purpose-built for investment communications, it combines the familiar flexibility of Microsoft PowerPoint for narrative building with the security of governed data and distribution-grade compliance. This approach balances speed, accuracy, and narrative quality.

*Illustrative preview

Distribution is a storytelling game

In a market where products are increasingly commoditised and fee pressure is real, storytelling is the last true differentiator. The firms that win will be those who:

- Turn data into dialogue rather than closing conversations.

- Personalise at scale to meet clients where they are.

- Deliver stories, not spreadsheets, that are memorable, compliant, and current.

Efficiency alone will not save us. Asset managers face volatile flows and margin pressure. Regulators are moving in the same direction. Under the FCA’s Consumer Duty, MiFID II / MiFIR as well as SEC regulations, communications must support customer understanding across channels and stages. Plain-language narrative, with clear risk and cost disclosures, is essential.

Industrialising storytelling

Moving from static decks to governed, narrative-led pitchbooks has measurable benefits:

- Preparation time falls as data is connected once and reused everywhere.

- Risk falls with centralised approvals and enforced disclosures.

- Win rates rise as clients finally hear the story that matters to them.

As Chief Product Officer, my role is to industrialise storytelling. To make it consistent, compliant, and scalable for every team and market.

The future of distribution is not who has the most data. It is who tells the most compelling, accurate, and auditable story. With our flexible reporting platform, we give distribution teams the power to do exactly that.

Keep an eye out for our next blog featuring Alex Dryden, macroeconomist and founder of Financial Fables. Alex publishes a weekly newsletter on markets and economic developments, and will share some insights and practical tips on the art of impactful investor communication.

FAQs:

- Why is storytelling more effective than data alone?

Stories are remembered up to 22 times more than facts. Data informs the mind, but stories connect to both head and heart. Together, they create impact that clients remember and act on. - What’s wrong with traditional pitchbooks?

Most pitchbooks are static, bloated, and out of date before they reach the client. They drown audiences in numbers instead of giving them a clear, memorable story. - Why can’t we just rely on spreadsheets and charts?

Spreadsheets show information but rarely persuade. Clients want clarity, context, and relevance. A story frames the data in a way that makes sense for their specific needs. - Why is personalisation so important in distribution?

One size fits all decks no longer work. Different investors care about different things. Personalisation shows you understand their priorities, which builds trust and improves engagement. - How does technology help with storytelling?

Technology transforms static content into live, dynamic, and compliant storytelling tools. With the Kurtosys platform, pitchbooks can update automatically, surface audience specific insights, and keep every message on brand and accurate. - What makes the Kurtosys platform different?

We combine the best of three worlds: PowerPoint native storytelling, governed data, and compliance guardrails. Unlike generic productivity tools or rigid reporting systems, we are purpose built for investment communications. - How does storytelling support Consumer Duty, SEC and accessibility requirements?

Plain-language narrative, with clear risk and cost disclosures, is essential. Investor communications must support the consumer’s understanding across channels and stages.

The Kurtosys platform helps to ensure that communications are up-to date, accurate and vetted at scale.

- What measurable benefits come from narrative led reporting?

Firms see less preparation time, fewer risks from outdated or inconsistent data, and higher win rates because clients connect with stories that resonate. - How does Kurtosys make storytelling scalable?

By centralising content and data, teams can design once and deploy everywhere. Pitchbooks, PDFs, and portal content can all be generated from the same governed components while ensuring consistency and compliance across markets. - Why is storytelling the future of distribution?

In a market of fee pressure and product commoditisation, story is the last true differentiator. Firms that tell clear, compliant, and compelling stories will win more meetings, mandates, and long-term client relationships.

References

- Stanford / Jennifer Aaker on why stories stick: stories remembered up to 22× more than facts alone. (womensleadership.stanford.edu)

- EY on digitisation and personalisation reshaping wealth client communications. (EY)

- CFA Institute on tech-enabled transparency & personalisation as trust multipliers. (CFA Institute)

- McKinsey on margin pressure and the productivity imperative in asset management. (McKinsey & Company)

- FCA Consumer Duty (PRIN 2A.5) and “fair, clear, not misleading” communications (COBS 4.2). (FCA Handbook)

- Power BI & Tableau: exports to PowerPoint are static (limitations). (Microsoft Learn, Tableau Help)

- Alpha FMC on client reporting operating-model focus and automation opportunities. (Alpha FMC, Asset & Wealth Management – Alpha FMC)