For asset managers, offering bespoke Excel reporting is a powerful way to win business. Institutional clients value the flexibility; it signals a true strategic partnership when you adapt to their specific operational needs rather than forcing a standard format upon them.

Anneliese Thomas - Head of Marketing, Kurtosys

A formula in one of yesterday’s spreadsheets didn’t behave the way you thought it would. The numbers are off. And just like that, a routine reporting task turns into a stressful crisis – one that could undermine client confidence and creates unacceptable operational risk.

There goes your day.

The double-edged sword of customisation

For asset managers, offering bespoke Excel reporting is a powerful way to win business. Institutional clients value the flexibility; it signals a true strategic partnership when you adapt to their specific operational needs rather than forcing a standard format upon them.

But this customisation is a double-edged sword.

On one side, you have a delighted client. On the other, if you are fulfilling these requests manually, you face an unacceptable operational risk. The very service meant to secure the mandate becomes the mechanism that could lose it.

We all know the cost of the resulting errors and delays. When a report is manually compiled, one formula error or copy-paste slip can undo months of relationship–building. A damaged client experience that can ultimately lead to lost mandates.

The ‘more hands’ trap

To keep up with volume, firms often add more people to the process. Teams swell to manage dozens of client-specific templates, spending hundreds of hours:

- Copying and pasting data

- Manually checking formulas

- Double-checking the checks

Yet, despite all that effort, all the extra headcount, the risk never disappears. Errors are easy to introduce, difficult to catch, and expensive to fix once they’ve been sent.

Manual custom reporting doesn’t just slow teams down. It creates ongoing pressure in a process that should inspire confidence, not anxiety.

How to break the manual reporting cycle

Fixing this requires more than just “working faster.” It requires a fundamental shift in how your data and reporting architecture is built. Through our work with asset managers, we have identified three pillars for solving the bespoke reporting challenge:

1. Centralise and standardise your data

Making sure all of your reporting teams have access to a single, central source of data is the foundation. Internal data warehouses are often too siloed and stuck behind technical firewalls, making them difficult for reporting teams to access. We see many of our clients moving to platforms like Snowflake and Databricks for this purpose. These modern cloud data warehouses offer much more granular controls to syndicate data, ensuring your teams have the fuel they need without the friction.

2. Decide where your calculations happen

This is where many firms get stuck. Many custom spreadsheet reports require bespoke calculations.

a) If you build these into your data store, you lose the flexibility to address client needs quickly when they arise.

b) If you bake them into your spreadsheet, you end up relying on complex formulas or Macros. This is a sure-fire way to create operational risk and dependency on specific team members.

3. Drop the copy and paste

Finally, creating automation around template creation is critical. You need a process that can update data in all your reports, at scale, without human intervention. This doesn’t mean forcing clients into a standard format; it means automating the bespoke format they asked for.

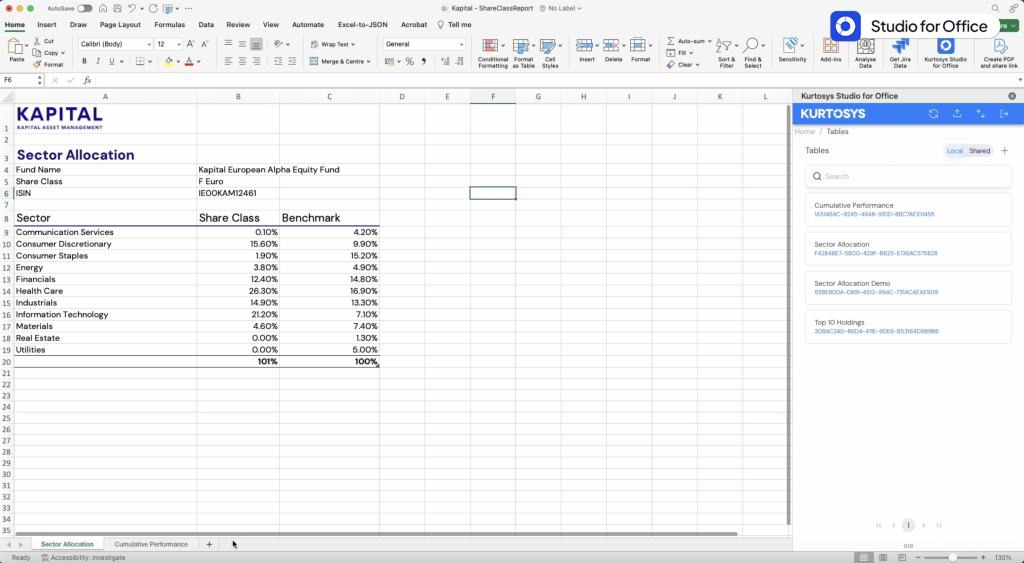

This is the philosophy that led us to build Kurtosys Studio for Excel. Integrated directly into our production centre, it allows you to map your data once and automate the population of spreadsheets at scale.

Ready to stop the fire drill?

Many of the conclusions above led us to build Studio for Excel. If you are interested in seeing how this architecture works in practice, reach out for a quick demo.

FAQS:

- Why is bespoke spreadsheet reporting risky for asset management firms?

Bespoke spreadsheet reporting relies heavily on manual processes such as copy-and-paste workflows, complex formulas, and individual expertise. This creates a high risk of human error, which can go undetected until reports reach institutional clients. Even small mistakes can damage client trust, increase remediation costs, and place reporting teams under constant operational pressure.

- What are the hidden costs of manual Excel-based client reporting?

The true cost goes beyond time spent building reports. Manual Excel reporting often requires additional headcount, repeated quality checks, and ongoing rework when errors occur. Over time, this leads to inefficiency, staff burnout, key-person dependency, and increased operational risk especially as reporting volumes and client customisation demands grow.

- Why doesn’t adding more people fix spreadsheet reporting problems?

Adding more people often increases complexity rather than reducing risk. Larger teams mean more handoffs, more versions of the same report, and more opportunities for errors to be introduced. Without a centralised data source and automated processes, manual reporting remains fragile regardless of team size.

- How can asset managers reduce operational risk in client reporting?

Reducing risk requires a shift away from spreadsheet-centric workflows. Best practice includes centralising data in a modern cloud data warehouse, introducing a controlled logic layer for calculations, and automating the population of client-specific templates. This approach improves accuracy, scalability, and consistency without sacrificing flexibility.

- Is it possible to automate bespoke client reporting without standardising everything?

Yes. Automation does not mean forcing all clients into a single template. The most effective reporting solutions automate bespoke formats by mapping data once and updating reports at scale without manual intervention. This allows firms to meet unique client requirements while eliminating repetitive, error-prone tasks.

- How does Kurtosys help firms move away from manual Excel reporting without disrupting existing workflows?

Kurtosys enables firms to keep using Excel while removing the manual effort and risk behind it. With Kurtosys Studio for Excel, reporting teams map data once to their bespoke templates and automate population at scale. Integrated directly into the Kurtosys production environment, it ensures reports are always populated with accurate, centrally governed data, eliminating copy-and-paste workflows, reducing formula risk, and maintaining full flexibility for client-specific formats.