Earlier this year, we shared the first part of our survey results, which revealed how customisation, automation, and data insights are driving the evolution of the investment industry. Our findings also underscore a clear shift towards AI-enabled workflows and more sophisticated digital experiences.

Part two of our survey looks ahead, exploring how firms are preparing for the future across three critical areas:

While asset managers analyse technology companies every day, many are still playing catch-up when it comes to adopting technology themselves. Striking the right balance between “good enough” and “next generation” solutions is key, enabling firms to future-proof their reporting capabilities without overspending or disrupting well-established operating models.

What’s clear from the findings is a growing focus on automation and self-service capabilities, allowing firms to deliver personalised, data-rich experiences that set them apart in a competitive market.

About the study

In partnership with Adox Research, we surveyed 65 investment managers to better understand how they prioritise customisation, automation, and data utilisation within their reporting functions.

Some of the key findings include:

These insights highlight that while progress has been made, data control, autonomy, and delivery remain ongoing challenges. The opportunity ahead lies in leveraging AI and automation to streamline operations by automating manual tasks, ensuring accuracy and timeliness, and giving managers more time to focus on delivering value to clients through real-time data and intuitive portals.

Now, let’s dive into the results from part two of the survey.

Integrating AI

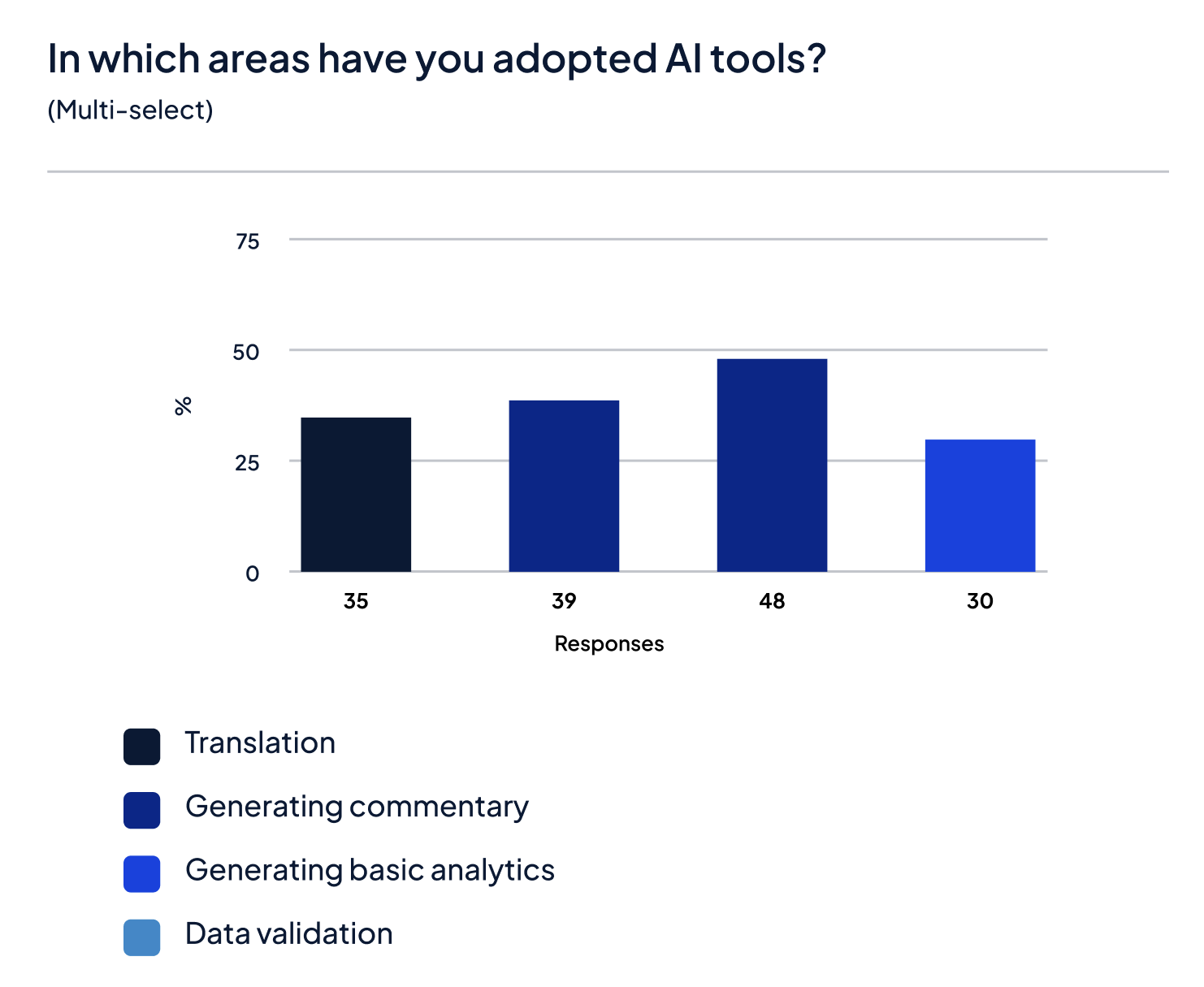

AI is no longer a future ambition for asset managers. It’s here, and it’s being integrated into some of the industry’s most critical workflows. From generating analytics and commentary to managing translation and reporting, firms are increasingly turning to AI tools to boost efficiency and accuracy across the business.

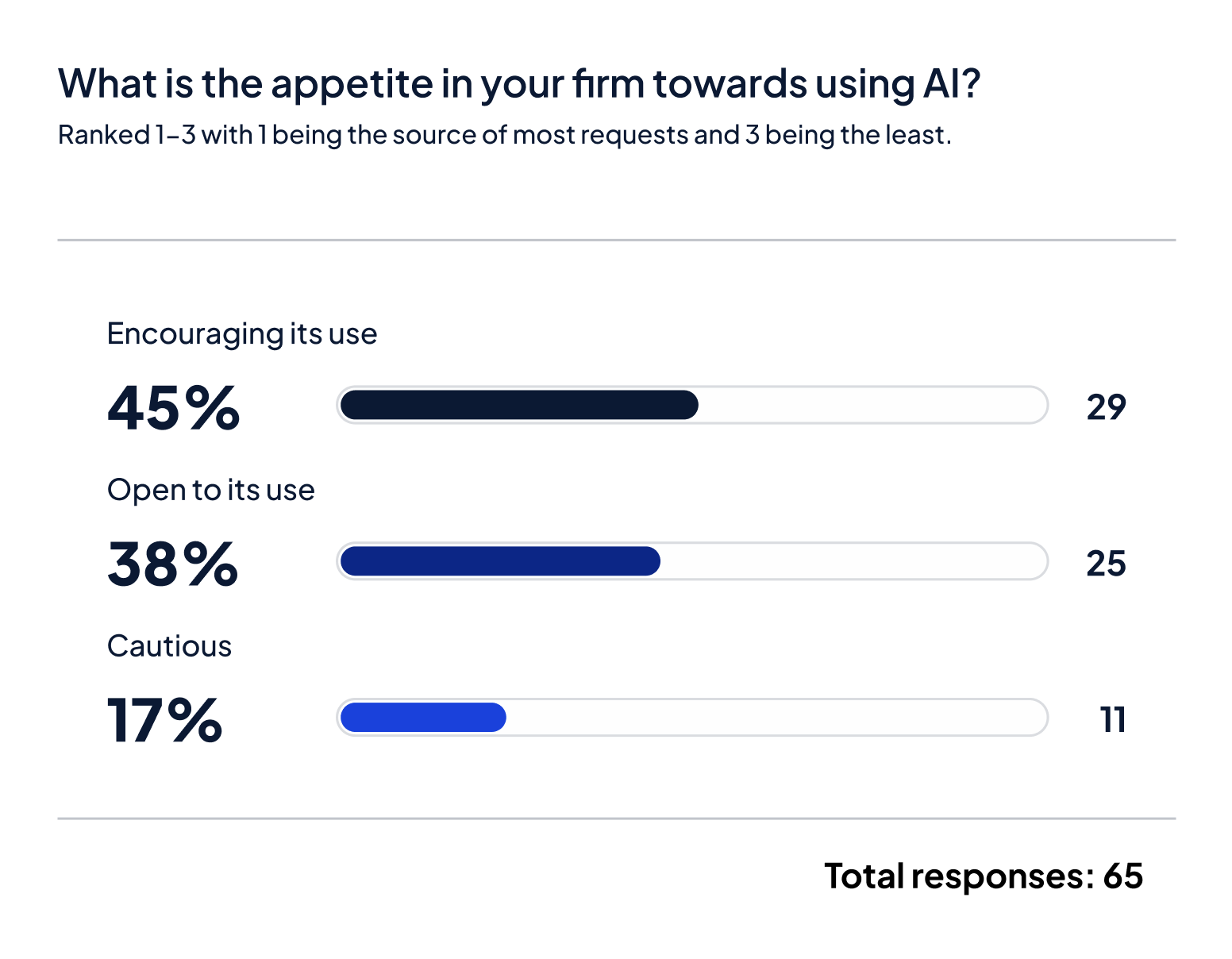

More than 80% of firms are either actively encouraging or open to AI adoption, signalling a clear commitment to innovation and transformation. Perhaps most notably, 66% of firms are already using language model-based AI tools in investor reporting workflows.

This represents a significant shift away from cumbersome traditional processes and frees up analysts, marketing teams and compliance specialists.

This evolution aligns closely with the industry’s push toward personalisation. In our earlier findings, over two-thirds of asset owners expressed a desire for more tailored reporting experiences; something that automation, AI and LLMs are uniquely equipped to deliver at scale.

Portals and the client experience

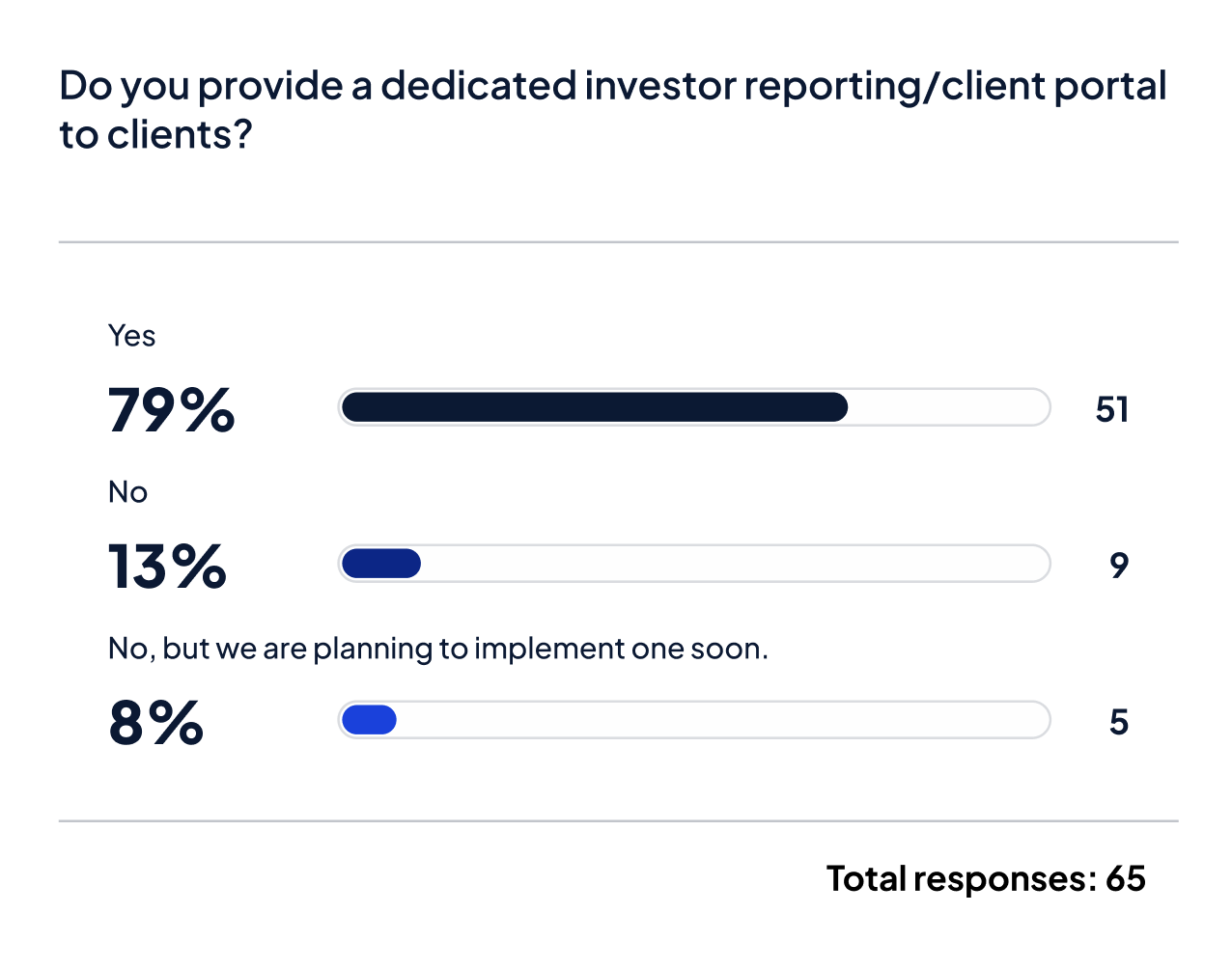

The client portal has officially become a cornerstone of the modern investor experience. Over 85% of respondents currently offer or are planning to implement a dedicated client portal, a clear indication that digital access and transparency are no longer optional.

But it’s not just about having a portal; it’s about how it’s used. With over 80% of clients wanting to self-serve, the ability to deliver real-time data, report customisation, and easy access to historical archives is becoming a key differentiator.

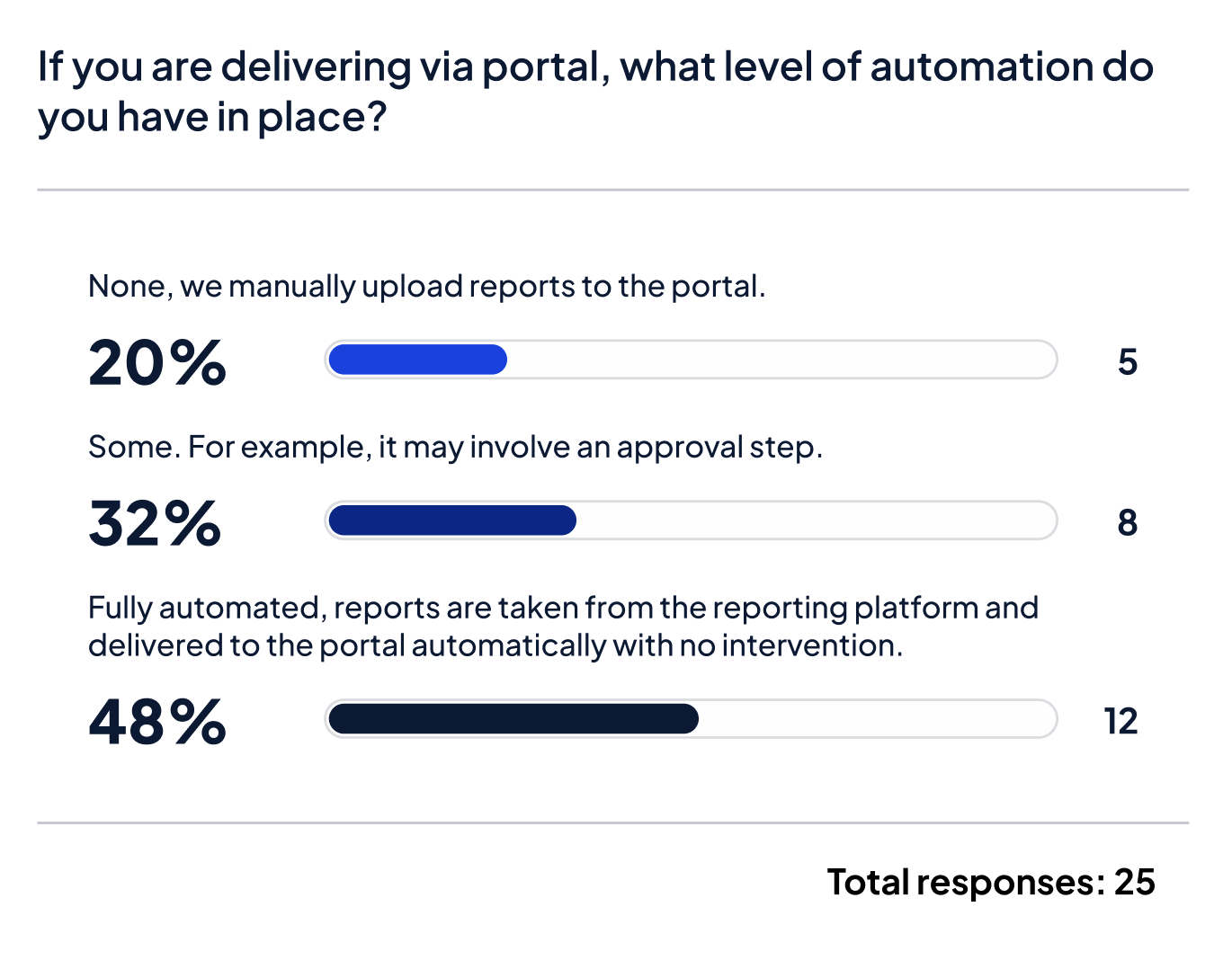

However, there’s still progress to be made. Only 48% of firms have achieved full automation in their reporting workflows – where reports are generated and delivered directly to the portal without manual intervention. The opportunity lies in bridging that gap to create truly seamless, real-time client experiences.

Encouragingly, firms are also prioritising feedback and engagement. Nearly 70% of respondents send regular client satisfaction surveys, reflecting a growing emphasis on continuous improvement and relationship building.

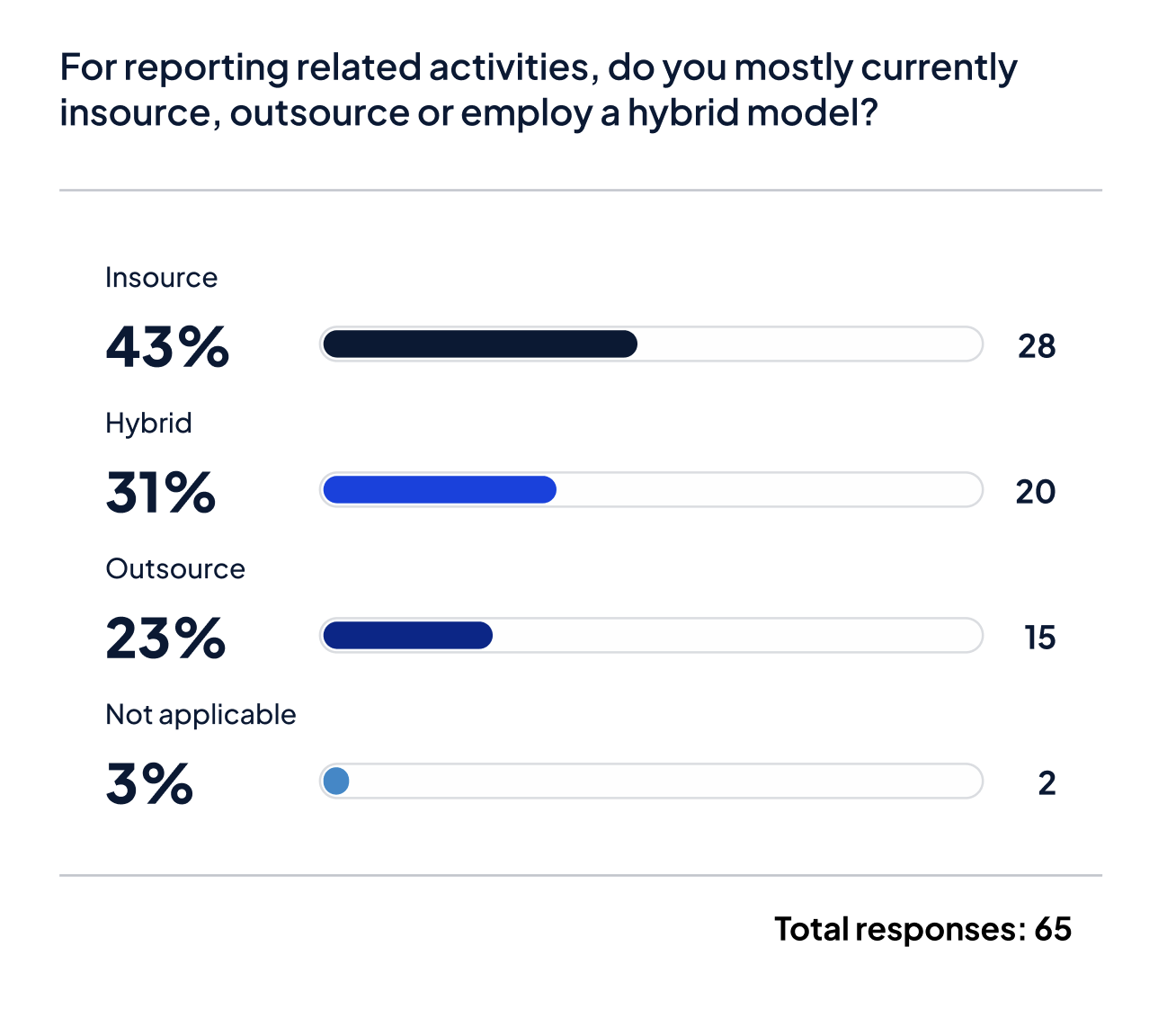

To insource, outsource, or to go hybrid?

When it comes to operating models, there’s no single dominant approach. Firms are mixing insourced, outsourced, and hybrid models depending on business priorities, resource availability, and client demands.

Many are choosing to insource key reporting functions to maintain tighter control over client deliverables. Yet, 64% of respondents plan to outsource certain elements within the next 18–24 months. The primary reason cited is the access to specialised technical expertise that’s difficult to maintain in-house.

This flexible, pragmatic mindset reflects a broader trend: asset managers are becoming more open, agile, and informed about how to integrate the right mix of technology, talent, and strategy to serve their clients effectively.

In our next feature, Solving the manual reporting nightmare we unpack the persistent pain points our team hears about daily, and how to solve them.

FAQ’s: Key insights on latest investment reporting trends

What is the future of investment reporting?

The future of investment reporting is being built on workflows, automation, and sophisticated digital client experiences, much of it enabled by AI. Our survey data shows a clear industry-wide shift toward self-service capabilities and delivering personalised, data-rich reports.

How is AI being used in asset management reporting?

AI is already being integrated into critical workflows. Our study found that 66% of asset management firms are using language model-based AI tools for tasks like generating analytics, writing market commentary, and managing translations, leading to significant efficiency gains.

What are the biggest challenges in investment reporting today?

Our survey highlights that data quality remains the top challenge, with 78% of firms still experiencing issues. Other major pain points include IT bottlenecks (55% require IT help for custom calculations), inefficient compliance workflows, and manual, time-consuming content updates.

Why are client portals so important for asset managers?

Client portals are now a cornerstone of the modern investor experience, with 85% of firms offering or planning one. This is because over 80% of clients want self-service capabilities, including real-time access to their data, customisable reports, and easy access to historical documents.

Download the white paper