In our recent blog, “The future of investment reporting: building on the data, automation and AI journey”, we explored the latest findings in our research around these core themes.

“The pain goes deeper. Teams tell me they’re drowning in their own content. They have vast libraries, but finding the right slide is a manual nightmare. On top of that, they’re battling inefficient approval workflows with compliance, struggling to keep branding consistent across all materials, and manually updating content every time data refreshes. They’re worried about reps using out-of-date regulatory disclaimers. This massive reliance on specialist teams for what should be simple tasks creates a huge drag on the entire reporting and sales process.”

AI as the catalyst for transformation

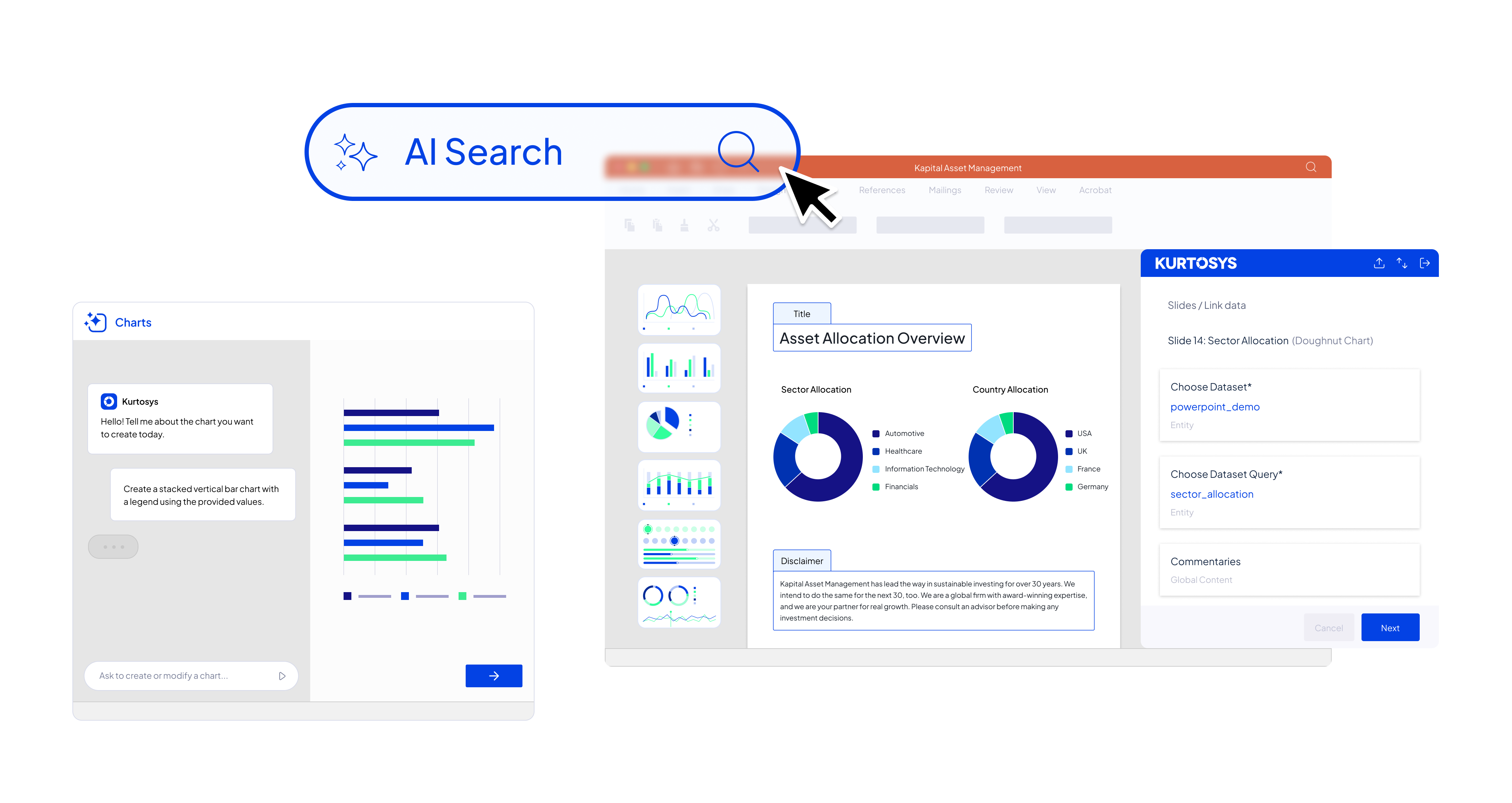

“These are precisely the pain points our product strategy is designed to solve,” explains Kauthar Marek, Lead Product Manager at Kurtosys. “Our product and engineering teams are focused on using AI to solve these exact workflow challenges. With the help of AI, we can fundamentally transform the reporting process. With AI powered search, users can instantly surface approved content from vast presentation libraries, eliminating the need for manual hunting. And with natural language chart generation, business teams can create charts and visuals on the fly, without waiting for IT support. This means business users are empowered to act quickly and independently, making teams dramatically more nimble and responsive.

This image is for illustrative purposes only.

These intelligent features work because they are built on a robust foundation. Our platform uses automated, template-driven workflows and style sheets to solve the manual creation and branding issues. We provide modular slide libraries and linked data that refreshes automatically, which eliminates inefficient content updates. Finally, we handle the compliance risk with automated approval workflows and the ability to enforce mandatory slides and business rules.

All features are developed with close attention to security, privacy, and responsible implementation, and frequent feedback loops with our clients.

Conclusion

By automating and streamlining processes that once required specialist intervention, AI is unlocking new levels of agility for asset managers. The days of waiting for IT to build custom reports or update slides are coming to an end. Instead, business teams can focus on delivering value and insights, confident that their tools are intelligent, secure, and always up to date.

AI adoption and practical applications are evolving at pace across the investment management landscape, and some valuable learnings are helping to shape initiatives in 2026. If you would like to be involved in a follow up study, have some learnings and insights to share, please reach out.

Frequently Asked Questions

- How can asset managers improve their reporting automation?

The key is to build a robust foundation first. This includes template-driven workflows, modular content libraries, and linked data that refreshes automatically. This strong, compliant framework is the prerequisite for successfully embedding intelligent and trustworthy AI tools. - How is AI transforming investment reporting for asset managers?

AI is driving true transformation in investment reporting by eliminating manual bottlenecks, enabling instant access to approved content, automating compliance, and empowering business teams to create and update reports independently, without relying on IT. - What are typical operational bottlenecks in asset management client reporting?

Many firms still struggle with manual updates, slow compliance workflows, and heavy IT dependency with 55% still requiring IT for custom calculations. These issues delay reporting and sales processes. - How does Kurtosys reduce IT reliance and streamline content creation?

Kurtosys enables business users to create materials using AI-powered content search, natural language charting, and automated templates. This dramatically reduces turnaround times and removes IT bottlenecks, making teams more nimble and responsive. - How does Kurtosys help improve compliance in investment reporting?

Built-in compliance automation, approval workflows, and linked data ensure only approved, up-to-date content is published. This reduces regulatory risk and ensures consistency across all materials. - Why is a strong operational foundation important before adopting AI?

AI works best on top of structured data, automated workflows, and consistent branding. Kurtosys provides this foundation through templates, style sheets, and modular content libraries.